stock option sale tax calculator

On this page is an Incentive Stock Options or ISO calculator. Please enter your option information below to see your potential savings.

How Stock Options Are Taxed Carta

Capital Gains Tax Calculator.

. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ordinary income tax and capital gains tax. Divide tax percentage by 100.

Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Exercise incentive stock options without paying the alternative. Regarding how to how to calculate cost basis for stock sale you calculate cost basis using.

Type of Option ISONSO. There are two types of taxes you need to keep in mind when exercising options. Just 1option to open 0 to close.

Ad Mini-SPX Index Options are 110 the Size of the Standard SPX Options Contract. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant. Check out our free Capital Gains Interactive Calculator that in just one screen will answer your burning questions about your stock sales and give you an estimate of how much.

Multiply price by decimal. To arrive at your potential take-home gains youll need to subtract your costs from the resulting gain in the stocks value. Poor Mans Covered Call calculator addedPMCC Calculator.

40 of the gain or loss is taxed at the short-term capital tax. Using this calculator is quite easy you are required to enter the following. Learn to Trade XSP Today.

To help such investors we have designed this stock profitloss calculator that gives you accurate results in seconds. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. For example a 30-day option on stock ABC with a 40.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Your Equity Administration Deserves Industry-Leading Strategies from Fidelity. Section 1256 options are always taxed as follows.

Your Equity Administration Deserves Industry-Leading Strategies from Fidelity. In our continuing example your theoretical gain is. 65 100 0065.

The AccuPay stock option calculator will allow you to do real time stock lookup to determine gain from selling stock and taxes owed. Stock Option Tax Calculator. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

When you exercise the option you include in income the fair market value of the stock at the time you acquired it less any amount you paid for the stock. And if you re-purchase the. The following table shows an example of how much stock option values would be at various growth levels for an employee who annually obtained 1000 stock option grants at a strike.

XSP Provides Greater Flexibility for Options Traders. The price of the coffee maker is 70 and your state sales tax is 65. This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario.

If you exercise a non-statutory option for IBM at 150share and the current market value is 160share youll pay tax on the 10share difference 160 - 150 10. Cash Secured Put calculator addedCSP Calculator. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

And a commission cap at 10leg. Click to follow the link and save it to your Favorites so. Use the employee stock option calculator to estimate the after-tax value of non-qualified stock options before cashing them in.

60 of the gain or loss is taxed at the long-term capital tax rates. How much are your stock options worth. Calculate your potential gains after taxes.

Find the best spreads and short options Our Option. Your basis in the stock depends on the type of plan that granted your stock option. Youre basing your investing strategy not on long-term considerations and diversification but on a short-term tax cut.

Enter the number of shares purchased. Employee Stock Purchase Plan - After your first transfer or sale of stock acquired by exercising an option granted under an employee stock purchase plan you should receive. New Tax Laws Recently there has.

Calculate the costs to exercise your stock options - including taxes. A long-term capital gains tax calculator calculates the tax on the profit from the sale of an asset according to your taxable income and your marital status. This permalink creates a unique url for this online calculator with your saved information.

Ad tastyworks is built for speed with features for the active trader. List price is 90 and tax percentage is 65. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Reverse Sales Tax Calculator 100 Free Calculators Io

Pin On E Commerce Business Strategy

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

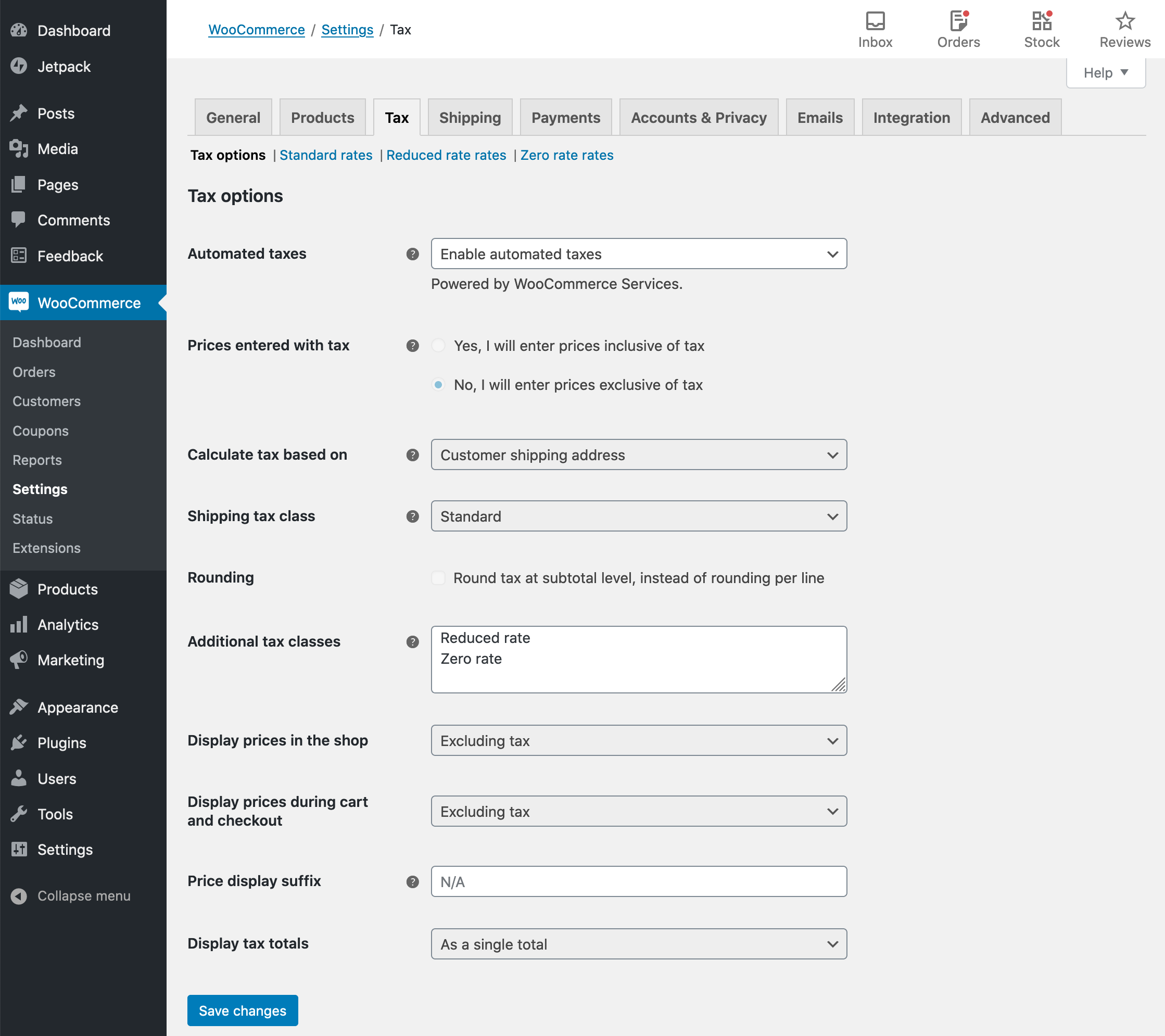

Setting Up Taxes In Woocommerce Woocommerce

How Stock Options Are Taxed Carta

New Functional Scientific Calculator Fx 991es Plus 1 75 4 Scientific Calculator Calculator Graphing Calculator

How To Calculate Cannabis Taxes At Your Dispensary

Woocommerce Tax Guide Woocommerce

Income Tax Prep Checklist Free Printable Checklist

1031 Exchange How Do Sales Costs Of Dst S Compare With Traditi Investing Corporate Bonds Selling Real Estate

Zoid Research Updates Get Updated Calls Summary On Stock Cash Stock Options Stock Future And Stock Premium For Free Trading Tips Click Http Goo Gl Adgex

Etsy Product Cost Calculator Google Sheets Labor Costs Materials Cost Calculation Spreadsheet With Excel 21

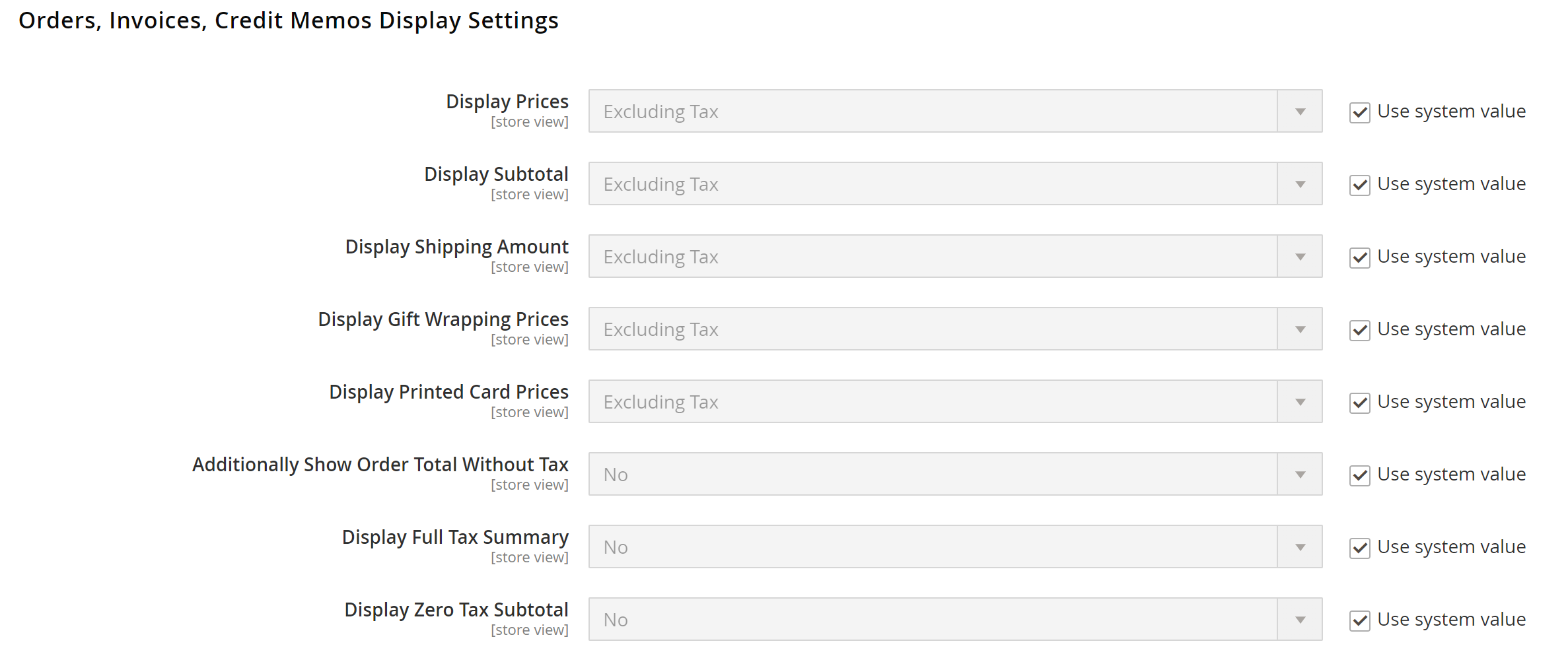

General Tax Settings Adobe Commerce 2 4 User Guide

Monthly Sales And Expenses Spreadsheet Summarizes Etsy Paypal Csv S

7 Helpful Tips To Choose A Right Career Option Elmens Sales And Marketing Jobs Dubai Sales Jobs